Kayci Jones

1.1 Module Summary

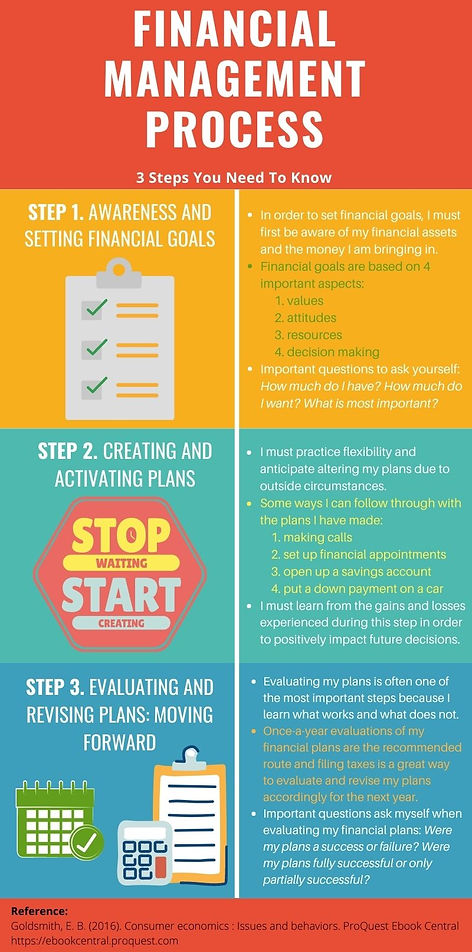

In this week's readings I learned about the three steps in the financial management process.

Step 1. Awareness and Setting Financial Goals

Step 2. Creating and Activating Financial Plans

Step 3. Evaluating and Revising Plans: Moving Forward

I also learned about the differences between bank accounts. The most common are savings and checking accounts. Savings accounts acquire low interests while checking accounts offer none. However checking accounts allow the use of checks while savings account do not. Interest-bearing checking is another account which is similar to savings accounts because it offers low interest and similar to checking accounts because it offers check privileges. Interest-bearing checking accounts also have high fees associated with them. A money market deposit accounts and certificate of deposit accounts offer high interest rates which encourage saving. Money market deposit also allows limited check usage and a high minimum balance while certificate of deposit does has no check usage and high fees associated with those accounts. I learned about these traditional banking services and discovered some possible reasons people choose to go another route. Some of the reasons to use non-traditional banking services is the lack of trust people may have for banks. There are stories of money being stolen and fraud etc. so many people may feel the need to not bank traditionally. People who have bad credit may not bank traditionally because they are unable to set up accounts due to their past bad history. People who do not receive a normal pay check such as nannies and people who receive payments in cash may not feel the need to do traditional banking if they use cash only.

Reference:

Goldsmith, E. B. (2016). Consumer economics : Issues and behaviors. ProQuest Ebook Central https://ebookcentral.proquest.com

1.3 Financial Management Process Infographic

.jpg)

1.4 Bank Account Word Cloud

Reference:

Goldsmith, E. B. (2016). Consumer economics : Issues and behaviors. ProQuest Ebook Central https://ebookcentral.proquest.com

1.6 Non-Traditional Banking Videos

These videos offer alternative options to traditional banking and how the alternatives can be more beneficial to you. Online banking offers better interest rates, 24/7 access to finances, and different ways to deposit checks that not all traditional banking options do. Other alternatives are credit unions because they typically have better benefits than traditional banks and PayPal, which is a payment processing gateway to quickly send and receive money, is favored over traditional banking because the transaction and purchasing ease. Many people without a credit score are not entitled to certain traditional banking options, so Esusu is an alternative to traditional banking that offers better saving options because it encourages saving and lending within small groups and communities.